how much taxes do you have to pay for doordash

However the good news for DoorDashers is that this means you can deduct expenses for a number of things related to your work when filing your own taxes. If I make 300 that day realistically I made 400.

Is Doordash Worth It After Taxes In 2022

Thats what I use as a fast easy estimate of my taxable income.

. Every day I work Im also making extra money by not owing it to the government. 2 days agoIf the winner opts to take the full 1 billion in winnings over 30 years they will receive annual payouts of 333 million on average before taxes. No tiers or tax brackets.

Its provided to you and the IRS as well. Additionally you will have to pay a self-employment tax. Do you have to pay DoorDash taxes under 600.

For the 2022 tax year the standard mileage allowance is 585 cents per mile for the first six months and 625 cents for the second half. So how do you know what. Solved You will owe income taxes on that money at the regular tax rate.

How much do you have to pay in taxes for DoorDash. An individuals credit may be reduced due to refund. Average day busting ass I get 100 in tax deductions.

Internal Revenue Service IRS and if required state tax departments. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes. This includes Social Security and Medicare taxes which as of 2020 totals 153.

This makes the average hourly rate for this job 20 per hour. You still have to pay taxes if you made under 600 and didnt receive a 1099. If youre in the 12 tax bracket every 100 in expenses reduces your tax bill by 2730.

A 1099 form differs from a W-2 which is the standard form issued to. There are no tax deductions or any of that to make it complicated. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US.

For example the statewide property tax on a home with a 100000 assessed. How much do you have to make on DoorDash to file taxes. Add up all your Doordash Grubhub Uber Eats Instacart and other gig.

A 1099-NEC form summarizes Dashers earnings as independent. Before the money reached the last winner the bounty was subjected to a 24 percent federal tax on gambling winnings as US tax residents must pay. How Much Tax Do You Pay On Doordash.

Its a straight 153 on every dollar you earn. The only difference is nonemployees have to pay the full 153 while employees only pay half. 1 day agoIRS takes most of the winnings.

While the 24 federal tax withholding. This calculator will have you do this. The only real exception is that the Social.

If youre self-employed though youre on the hook for both the employee and employer portions bringing your total self-employment tax. In some regions we offer DashPassa subscription program that offers a 0 delivery fee and reduced service fees for subscribers when ordering 12 or more from any DashPass-eligible. 2 days agoTo be eligible for a refund the administration said individuals must have filed a 2021 state tax return on or before Oct.

While 625 cents may not seem like. Kentucky currently has a statewide property tax rate of 122 cents per 100 in assessed value. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes.

To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153. The main exception is if you made under 400 in. The forms are filed with the US.

A 1099 form differs from a W-2 which is the standard form issued to. Most DoorDashers report making between 15 and 25 per hour. However carefully choosing when and where.

If you made 5000 in Q1 you should send in a Q1. Thats 12 in income tax and 1530 in self-employment tax.

How Many People Use Doordash In 2022 New Data

Tips For Filing Doordash Taxes Silver Tax Group

Doordash Pushes Back Against Fee Delivery Commissions With New Charges

Pro Door Dasher Shares Tips To Maximize Your Earnings

Doordash Driver Review How Much Money Can You Make

Doordash S 3 Laws Of Deception I List Out 3 Ways In Which Doordash By Rahul G Medium

How Much Does The Average Doordash Employee Make Per Hour Quora

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash Driver Review How Much Money Can You Make

How To File Doordash Taxes Doordash Drivers Write Offs

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

Doordash Workers Protest Outside Ceo Tony Xu S Home Demanding Better Pay Tip Transparency And Ppe Techcrunch

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier

Doordash Driver Canada Everything You Need To Know To Get Started

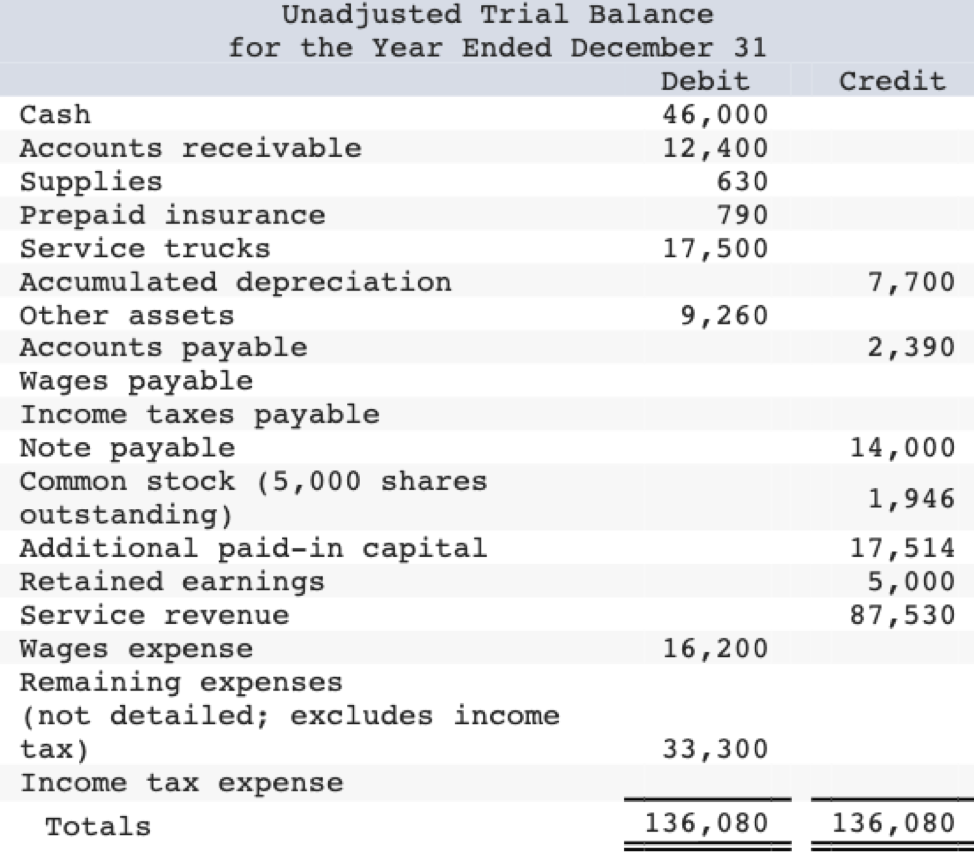

Solved Doordash Hired An Outside Accountant To Prepare The Chegg Com

Doordash 1099 Taxes Your Guide To Forms Write Offs And More